Vehicle depreciation calculator taxes

When its time to file your. Work-related car expenses calculator.

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

. The calculator makes this calculation of course Asset Being Depreciated -. Suppose that you use a business vehicle 100 of. Section 179 deduction dollar limits.

Years 4 and 5 1152. D i C R i. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. C is the original purchase price or basis of an asset. R10 99583 x 11 x 112 R10080 2.

The result shows how much the depreciation is anticipated to be in the first year and during the total. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the. Vehicle bought on 30 Sept 201.

Example Calculation Using the Section 179 Calculator. Cost x Days held 365 x 100 Effective. To compute business vehicle depreciation for the year you must multiply the basis amount by the percentage of business use of your vehicle.

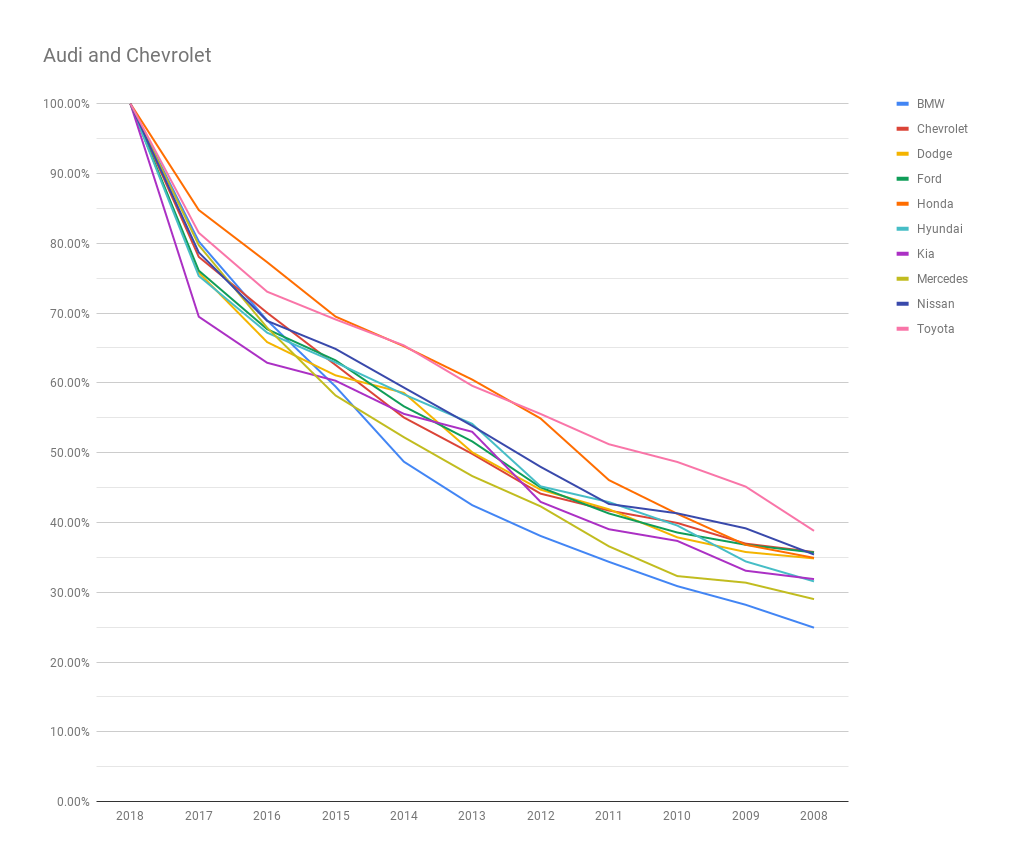

Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. By entering a few details such as price vehicle age and usage and time of your ownership we. This calculator may be used to determine both new and used vehicle depreciation.

Where Di is the depreciation in year i. The MACRS Depreciation Calculator uses the following basic formula. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. So 11400 5 2280 annually. This limit is reduced by the amount by which the cost of.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. Prime Cost Method for Calculating Car Depreciation Cost of Running the Car x Days you owned 365 x.

Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership. Depreciation on Vehicle sold. Year 1 20 of the cost.

According to the general rule you calculate depreciation over a six-year span as follows. Use this depreciation calculator to forecast the value loss for a new or used car. SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life.

Vehicle bought on 1 April 206 during the financial year therefore 1 month of depreciation. We will even custom tailor the results based upon just a few of. To calculate the depreciation of your car you can use two different types of formulas.

It can be used for the 201314 to.

Car Depreciation Rate Calculator India Irdai Vehicle Depreciation Rates India

Car Depreciation Rate And Idv Calculator Mintwise

Depreciation Calculator Depreciation Of An Asset Car Property

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

Car Depreciation Calculator Online 53 Off Www Wtashows Com

When Depreciation Is Your Friend Reasonable Rides

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

When Depreciation Is Your Friend Reasonable Rides

Car Depreciation Calculator

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Macrs Depreciation Calculator Based On Irs Publication 946

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Free Macrs Depreciation Calculator For Excel

Pin On Insurances

Fresh Used Car Sales Near Me Check More At Https Www Toyotasuvsreview Com Used Car Sales Ne Used Cars Used Car Prices Honda Civic Hybrid